Dexcom’s Tumble and the Ill-fated G7 Sensor

Marketing hype can only take you so far

On September 19, Dexcom’s stock tumbled 11% in one day. This is really unusual for a company as mature and successful as Dexcom has been. Most people don’t really follow financial news closely, but if you’re a T1D, then the reasons are likely going to affect you.

But first, the backstory.

When Dexcom released the G7, I was as excited as everyone else about many of its new features. We’re all familiar with them now. But the company had also promoted the G7 as being more “accurate” than the G6, and said that they were going to discontinue the older model within a year or so.

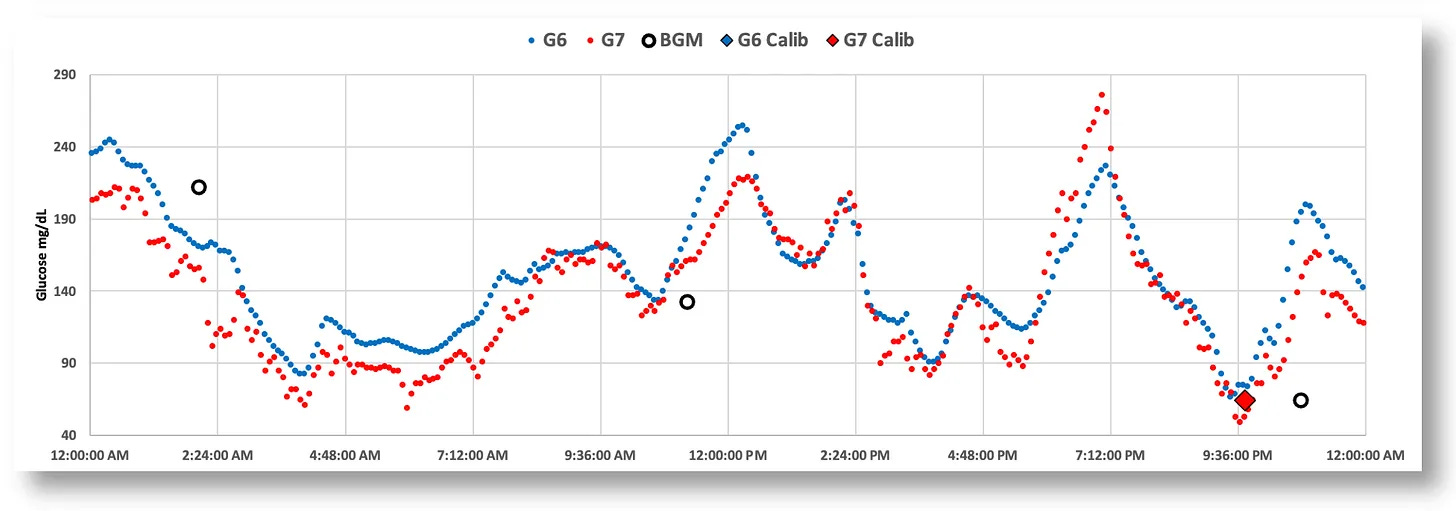

In March of 2023, when I got my hands on the new model, I still had a number of G6s, so I decided to wear both sensors at the same time. After a few days, it was immediately clear that the G7 had some serious problems. Here’s a chart that illustrates data from both sensors. (The G6 is blue, and the G7 is red. BGM readings are black circles.)

So, I got busy doing a great deal of research on CGM technology, blood glucose physiology, and related matters, such as automated pump algorithms, and so on.

By November of 2023, I had finally produced my article, Continuous Glucose Monitors: Does Better Accuracy Mean Better Glycemic Control?. While the article does talk about my self-administered experiment wearing both sensors, the real meat of it is how glucose actually moves around the body, and the way the G7 is measuring it cannot possibly be a good, viable product. That article continues to be the most read article on my Substack.

Most importantly, I called attention to Dexcom’s claim that the G7 was the most “accurate” sensor on the market, and whose MARD rating was superior to all others. I stated that these terms were entirely marketing hype, and called attention to technical papers stating that MARD is a useless metric, and that CGM certification processes should be changed. I predicted that the sensor would eventually face serious setbacks once it was clear the emperor wasn’t wearing any clothes.

This brings us to September 19, 2025, when a report by Hunterbrook Capital called, Dexcom’s Fatal Flaws, centered on these areas:

G7 Device Issues

The report claimed to have found evidence that Dexcom implemented an unauthorized design change to a key G7 sensor component (a coating material) in December 2023. Internal company studies allegedly showed this new material was inferior by “every accuracy metric.” This change led to the FDA citing Dexcom with a violation for selling “adulterated” devices. The report linked these issues to patient hospitalizations and deaths.

Executive Exodus

The report noted several executive departures, including the unexpected leave of absence taken by long-serving CEO Kevin Sayer, which added to the scrutiny.

Accounting Questions

Hunterbrook questioned Dexcom’s accounting practices, suggesting the company used aggressive tactics to meet earnings expectations, specifically pointing to a significant ballooning of its day’s sales outstanding.

User dissatisfaction

A Facebook group dedicated to complaints about the G7 device had grown to over 58,000 members in just over a year, demonstrating the scale of user frustration with the product’s performance, adhesives, and failure rates.

Hunterbrook spoke with endocrinologists across the country, many of whom specifically highlighted the G7’s disproportionate problems.

Disproportionate sensor inaccuracies.

Repeated device failures.

Connectivity issues.

Adhesive problems.

The report concluded that doctors told Hunterbrook they have stopped putting new patients on the G7 altogether and are instead advising patients to switch back to the G6 or move to a competitor’s device (such as Abbott’s Libre 3).

Now, to be clear, Hunterbrook is an investment company that is betting against Dexcom. (That is, they have a “short position”, which means they’re betting on the stock going down.) Many perceive this as a form of bias, which is not inherently incorrect. However, the allegations are not untrue. Whether the company recovers from this is unknown.

Nevertheless, I feel compelled to post this, largely to bring even more awareness to the problems with the G7, especially for those where it can pose serious health consequences. There’s a reason for the very large Facebook group, and other T1D discussion groups are expressing similar problems with the G7. This is not bias or conjecture.

My greatest concern right now is that the company is sticking to its statement that they are going to discontinue the G6, which would be catastrophic, not just for the company, but for T1Ds.

I think the bigger picture is being missed here. And I really don't want to engage for too long on this, as its outside the main intent of my substack, which is really about the intricacies of T1D management, which includes both biology and the utilization of tech.

The main critique of Hunterbrook's analysis was not necessarily the list of problems they cited, which the commenters in this discussion (and elsewhere online) have focused on. It was THAT those situations arose because executive management is showing an inability to either avoid these problems, or fix them. Worse still, they reflect poor strategic planning (market projections and future product development).

The company has never been able to grow without expanding beyond the T1D space, so their ambitions naturally encroach on the T2D market, and life-hackers (non-diabetics who like to use wearables for physical performance tracking).

It's in that light that Dexcom's goal affected product decisions. First, the aimed claim the most "accurate" sensor on the market, which meant achieving a very low MARD rating. T do that, however, the algorithm the determines each glucose reading needs to closely match the blood glucose analyzer in clinical trials. The mistake was assuming that these superior MARD ratings would actually yield a superior device.

As the product rolled out, quite the opposite has happened.---AID systems perform worse and most users got frustrated not actually knowing how to interpret glucose movements.

They should have known--or at least, prepared for--the fact that MARD itself is the wrong way to measure the performance of a CGM. The way glucose moves in the body is more erratic and volatile (as my original article explains in detail), so matching glucose levels only ended up reflecting that erratic movement. As was later discovered, this is not a very useful metric for T1D management.

This not only has impacted the G7's sales, but has moved many G6 users to other products.

Worse, the strategic missteps are going to get worse as the company prepares to roll out the next generation of sensors that will measure ketones as well. This is going to be a risky and expensive turning point because DKA is more of a boogeyman that doesn't really pose a threat for most T1Ds, despite how often it's discussed with healthcare providers. The *fear* of it is real, but as my article details, the actual risk is extremely low. See: https://danheller.substack.com/p/ketones-the-unjustly-demonized-villain

Once the new CGKM products hit the market, it'll take a few sales cycles where people will start reporting that detecting ketones is much ado about nothing, and this could impact sales, because those devices will cost a lot more than a non-ketone CGM.

If that happens alongside the continued slide of the G7, then Dexcom's price could suffer even more.

Key takeaway: This is not about T1Ds, and it's not about intermittent problems with the physical device and customer service that could (and may) be fixed. Those are important *because* they reflect an executive team that is unprepared to play in the major leagues, especially when it comes to making strategic decisions.

I posted this because I feel very strongly about Dexcom's threat to discontinue the G6, which I find to be THE most effective tool for T1D management. Its readings are highly reliable for making in-the-moment dosing the decisions in a shorter window of time than any other sensor on the market. Again, I encourage people to read my original analysis on the G6 vs. G7 from two years ago: https://danheller.substack.com/p/the-dexcom-g7-vs-g6-which-is-better

... and the Libre siren call grows sweeter still...